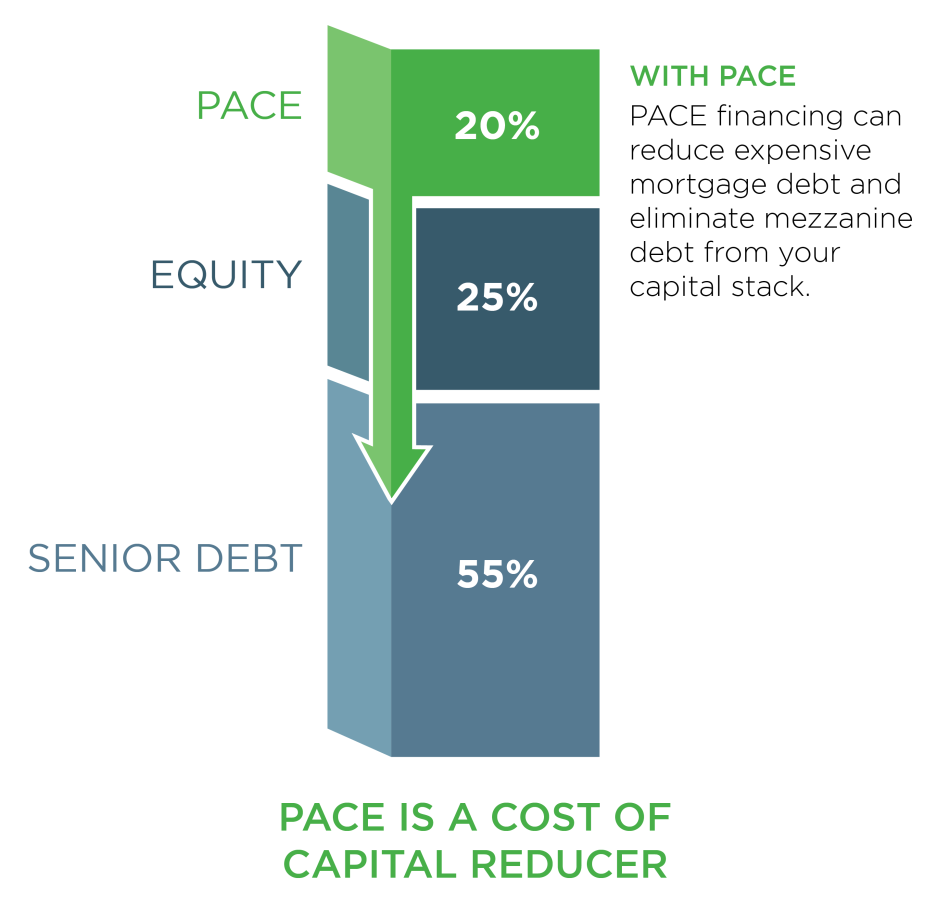

In the ever-evolving landscape of commercial real estate, two pressing concerns loom large: managing interest rate exposure and meeting the market’s demand for sustainability. Balancing the financial bottom line with green building objectives can often feel like an uphill battle. However, a financial tool – retroactive Commercial Property-Assessed Clean Energy (C-PACE) financing -- is making waves in the CRE finance industry, offering a compelling solution to these challenges. This financing not only injects much-needed liquidity into projects but also rewards sponsors for building sustainably.

What is retroactive C-PACE financing?

Many property developers have faced a double whammy of cost overruns and maturing construction loans. Whether increasing interest rates is impacting refinancing options or increasing material costs are causing the overage, sponsors need creative solutions to close the financing gap.

Retroactive C-PACE financing becomes the project’s savior by allowing reimbursement for eligible work completed anytime in the last three years, injecting fresh capital into a project. Eligible work includes energy efficiency, seismic resilience, and renewable energy improvements, which also meet sustainability benchmarks and decrease the annual operating expenses for the asset.

The Key Benefits:

- Liquidity Injection: Cash flow is the lifeblood of any project. This financing option infuses liquidity, easing financial strain, and enhancing project stability. Many clients use this injection of capital to paydown maturing mortgage debt in exchange for a extension.

- Budget Overage: With retroactive C-PACE financing, you can redirect funds directly to cover cost overruns, ensuring your project remains financially viable.

- Sustainability Advancement: Retroactive C-PACE financing enables the retrofitting of existing structures and new construction, reducing carbon emissions and annual operating costs while meeting sustainability benchmarks with ease.

One recent project demonstrates how C-PACE can be a creative, flexible savior for capital stacks:

At Four Seasons Hotel at RBC Gateway in Minneapolis, PLG provided $20 million in long-term, fixed-rate retroactive C-PACE financing for energy-efficient building envelope, HVAC systems, domestic hot water, high-efficiency water fixtures, lighting, and mechanical systems within the hotel portion of the overall development. These improvements are expected to generate $1.4 million in annual energy savings.

In an industry that's constantly evolving, retroactive C-PACE financing is proving to be a transformative financial tool that addresses budget overruns while advancing sustainability goals. By tapping into energy efficiency dollars and allowing property owners and developers of all asset classes to reimburse themselves for past work spread financing over 20-30 years, this innovative financing mechanism empowers projects to thrive financially while making significant strides towards a greener, more sustainable built environment.

For those looking to build a sustainable and budget-friendly future, the path forward may just be through retroactive C-PACE financing.

Do you have a project seeking financing? Please connect with us: https://paceloangroup.com/get-a-quote

PACE Loan Group (PLG) is a national leader in the C-PACE marketplace, providing direct C-PACE financing to commercial property owners. PLG benefits from institutional support from funds managed by AB CarVal, a subsidiary of Alliance Bernstein. The PLG team strives to educate property owners while providing expertise up and down the capital stack, from origination and underwriting to loan servicing. To learn more about PLG, visit www.paceloangroup.com.