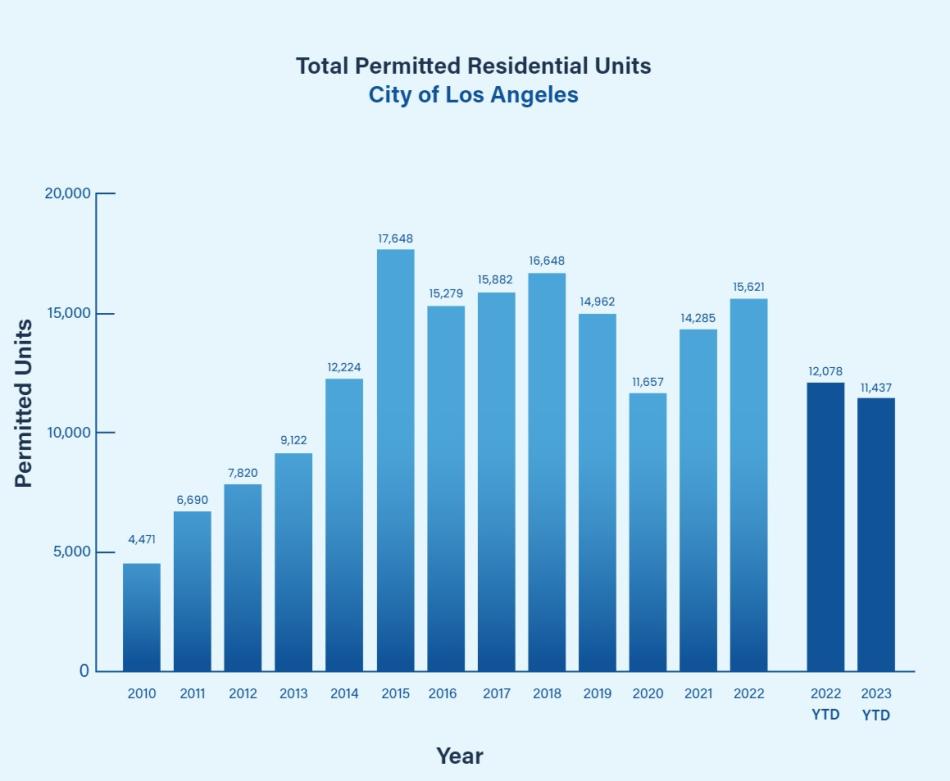

The shrinking number of cranes which dot the Los Angeles skyline over the past year has been a sign of a cooling market for new development in the city. That visual evidence in a new report from Hilgard Analytics, which analyzes data from the L.A. Department of Building and Safety.

"Throughout the City of Los Angeles, 11,437 residential untis were permitted through the first three quarters (January to September) of this year," writers Shoshana Baum of Hilgard Analytics. "This represents a fall of 5.3%, or 641 units in absolute terms through the same period last year. To reach the same level of permitting that the city had for the entirety of last year of 15,621 units, 4,184 units must be permitted by the end of the year."

The report points to a number of changing factors impacting development in Los Angeles, including rising interest rates, a cooling job market, and various labor disputes which have made a less desirable environment for development. That was the case for most of the city, with the exceptions of :

- Council District 1 (Chinatown, Westlake, Northeast Los Angeles), which has seen 1,049 homes permitted in 2023 versus 845 through the same period in 2022;

- Council District 8 (Baldwin Hills, Crenshaw, Jefferson Park), which has seen permitting skyrocket from 422 units in 2022 to 2,622 units in 2023;

- Council District 10 (Koreatown, Mid-City), which saw production increase from 1,361 permits in 2022 to 1,712 permits in 2023; and

- Council District 13 (Hollywood, Echo Park), which has permitted 1,676 units in 2023, up from 1,537 units in 2022.

While a slowdown in housing production is perhaps unwelcome news for a city that is facing pressure to increase the pace of construction, Baum writes that the current dip may be a short-term problem.

"While interest rates are likely to remain fairly high for a while, the other factors that have been contributing to this decline in permitting are likely to go away or be mitigated, likely leading to a resurgence in residential permitting numbers," reads the report, which points a historically supply-constrained market as reason for an eventual comeback.

Read more here.

Follow us on social media:

Twitter / Facebook / LinkedIn / Threads / Instagram