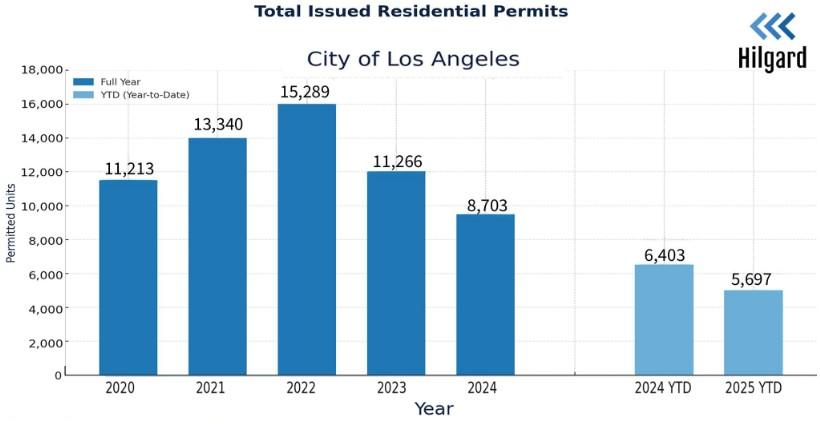

After signs of a turnaround in the second quarter, residential permitting in Los Angeles has continued to trend upward in recent months, per a new report from Hilgard Economics.

From the start of July through the end of September, Los Angeles permitted 2,557 new residential units. That was up from 1,816 units in the second quarter, which was itself an improvement on the 1,324 units permitted in the first quarter. The third quarter results were also a roughly 60 percent improvement over the same period in 2024.

"Part of the improvement reflects approved rebuilds in the Pacific Palisades, where homes destroyed or damaged in January's Palisades Fire are now moving through the permit pipeline," explains the report. "The approvals added noticeable volumes to the third quarter total and helped lift citywide figures."

Still, the report points out that factors such as inflation, high interest rates, and ever-changing immigration and trade policies under the Trump administration have hampered permitting overall. The citywide total of 5,697 units permitted in 2025 is an 11 percent drop from the 6,403 units permitted by this point in 2024. Likewise, Los Angeles commonly approved more than 13,000 new units each year between 2015 and 2022, with the exception of 2020, when the global pandemic brought the market to a standstill.

Moving forward, recent state legislation also has the potential to boost housing construction, albeit not in the short term due to market conditions. That includes AB 130, which introduced new CEQA exemptions for infill housing, as well as SB 79, which overrides local zoning regulations to permit larger developments near transit. Pending reform to California's building code could also clear the way for single-stairway apartment buildings, potentially making smaller parcels viable for development.

New funding gleaned from the controversial Measure ULA transfer tax is also expected to provide $378 million for affordable housing in the City of Los Angeles. However, as Measure ULA money cannot be combined with other gap-financing sources, that total is expected only to generate between 450 and 500 units, per the report.

According to the report, Los Angeles may come close to matching its housing production totals from 2024, but reaching levels seen in preceding years will depend on better conditions for financing. Factors such as high borrowing costs and the ongoing risk of tariffs have continued to keep developers cautious.

Follow us on social media:

Twitter / Facebook / LinkedIn / Threads / Instagram / Bluesky