During this month’s meeting of the Metro Board of Directors, there was a protracted discussion about how Measure M’s local return fund would be apportioned to the 88 cities and unincorporated Los Angeles County. While in the past return dollars have been doled out on a strictly per capita basis, the new sales tax might work a little differently. The local return working group for Measure M (h/t Henry Fung) came up with a plan that would set an annual minimum amount that all jurisdictions would be guaranteed regardless of their population. The money to push these very small cities up to the floor amount would be carved out of the overall local return pot for the year, the remainder of which would then be distributed to the larger cities. The idea of the floor is to protect very small cities, according to the directors who spoke on its behalf, since these cities are unlikely to benefit in meaningful ways from the megaprojects that will be funded in the coming decades. Due to their size, some of these cities are so small that they will receive on the order of $10,000 annually in return funding, which is not enough to make headway in local transportation spending, the argument continues.

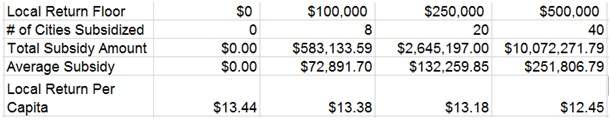

Metro’s board instructed staff to look at the impacts of a floor on local return allotment, but we don’t need to wait for their report to get a sense of what this policy would do. In its first year, Metro’s new sales tax is projected to draw $860 million in new revenue. The local return funding, 16% of the total, will therefore start at $137.6 million annually. With the county’s population over 10 million, each jurisdiction will get approximately $13.44 per resident this year, with future amounts subject to change based on relative population and overall economic activity.

Metro CEO Phil Washington stressed during the board meeting that there has been no decision yet on the exact level that a floor might be set at, but $100,000 was mentioned as potentially acceptable level. Which cities, based on their population, would receive less than $100,000 in local return funding? The list is short. Avalon, Bradbury, Hidden Hills, Industry, Irwindale, La Habra Heights, Rolling Hills, and Vernon are the only eight cities below that mark.

With 16,000 residents combined, the cities have some notable similarities. They belong to one of two groups: wealthy residential communities, and industrial tax havens. Each has a reason for artificially keeping its residential population low. More residents would cut into the geographic remove of the former’s palatial estates, and, for the latter, residents are also a nuisance. After all, they demand tax-funded services and diverse land uses that might not be compatible with concrete plants, Sriracha factories, superfunds, and so forth. Of the eight cities, only one (Irwindale) even voted to pass Measure M.

This group makes a questionable set of targets for a handout like this. The poor cities in Los Angeles County are characterized by their density and crowding. Even small poor cities have far too many residents to hope to benefit from this proposed policy. And, though, as Director Garcia pointed out, $100,000 might not buy a single curb cut, it strikes me that the county has greater equity issues than Hidden Hills having to pick between a curb cut for Drake and one for Kanye. There are undoubtedly real ADA concerns that could be addressed in any of these cities, but, nonetheless, it is difficult to stomach compounding a regressive sales tax with an active redistribution from poorer cities to wealthier ones.

The carve-outs required to fund the local return floor vary in size depending on how many cities receive the subsidy, and the size of the subsidy. As the floor rises, the per capita amount available for the unsubsidized cities falls.

In the scenarios shown above, using a minimum annual allocation for local return funding can play a few different ways. With the $100,000 floor, a small amount of overall funding is redirected, so this scenario is minimally disruptive to the county’s more populous jurisdictions. On the other hand, what have we accomplished here? The eight cities subsidized here are not just below the floor, they’re far below it, requiring an average subsidy of 73% to reach the minimum. That minimum, as indicated by the comments of several directors, is seen as insufficient to accomplish the road paving and sidewalk maintenance for which it’s needed. In this scenario, we’re moving money around aimlessly, but without major consequences.

If a $250,000 annual minimum were selected, we would add to the ranks of the aggrieved the likes of Malibu, Westlake Village, and San Marino, where commercial zoning is intentionally suppressed and multi-family housing is forbidden outright. The $500,000 annual minimum level, which seems just comically high, would siphon 7% of the total local return pot. Even though we are by now capturing nearly half of the jurisdictions in the county, we are still only giving benefits to 7% of county residents, effectively doubling their share of local return funding per capita. In this scenario, these small cities would certainly be able to afford more than a curb cut, but the largest part (about 38%) of the redistributions from the local return floor would go to those original 8 cities with the county’s lowest populations. If these cities lack the necessary funds to pave their roads, or paint bike lanes, it is wholly a concern of their internal political priorities. The higher the floor is set, the more spurious claims to equity appear.

These cities have tailored the public goods they provide so as to ingratiate themselves to wealthy residents or wealthy business interests in a form of aggressive Tiebout sorting, a process in which fragmented municipalities operate as a “market” for public goods that allows citizens to determine the optimal level of local taxation. In reality, the purported positive effects of such sorting are all but negated by, just for example, the use of exclusionary zoning in San Marino to preempt migration into the city, or the rampant externalities of a Vernon, which has repeatedly poisoned the poor residential communities that surround it.

If cities such as these are failing to generate the necessary taxes to provide services to their few residents, the reason is that their model is failing. Solutions could be to diversify their land use, expand their tax base, and increase their population. However, the solution should not be for large and small poor cities to donate their tax dollars to small, wealthy cities to bail out a system that, it could be argued, plays an outsize role in stabilizing intraregional inequality. Metro should reject the proposal of a floor amount for local return, and continue to issue funding on a per capita basis.

Scott Frazier is a graduate student at Cal State University Los Angeles in Public Administration. Follow him on Twitter @safrazie.