Murray McQueen is a real estate veteran and President of Tribune Real Estate Holdings, formerly the real estate subsidiary of Tribune Media, which was acquired by Nexstar. Prior to that, McQueen was a co-founder and managing partner of Channel West Group, established in 2011, and managing director at Cerberus Capital, from 2005 to 2011. Other career stops include stints with Credit Suisse First Boston/DJL Real Estate and Citicorp Real Estate.

Jake Goldstein: My first question is: What exactly is Tribune and how does the real estate tie back to Tribune?

Murray McQueen: The short version is that Tribune was a vast media company owning lots of newspapers, TV stations, internet assets, etc. It was taken private in 2007 by a group of Chicago based investors. When the financial crisis hit in 2008, it filed bankruptcy. Lots of very sophisticated owners and investment funds bought up the debt for pennies on the dollar and emerged as owners of the company. Tribune owned some amazing real estate. The investors asked how to capitalize on that? So, they hired me and asked me to formulate and execute some business plans.

JG: How did they initially approach you and what was your initial reaction?

MQ: They approached me through an executive recruiter, and I also knew some people at one of the ownership companies. When I looked at the real estate assets that they owned; these large irreplaceable assemblages in the middle of cities; I was very excited because I’ve always enjoyed doing urban in-fill redevelopment. That was of one of the reasons I began in real estate. I don’t want to overemphasize networking but having people aware of what you are doing and what you want to do helps.

JG: Always should put yourself out there, right? You are a part of a lot of these organizations.

MQ: Yes.

JG: What I thought was the most interesting part of your Tribune position is the many different types of real estate and locations you handled during your ten-year career there. It required a lot of knowledge to succeed. So please tell us about your journey in real estate.

MQ: I’ve done a lot of different things. I became a jack of all trades, master of none. I went to graduate school at UCLA-Anderson. I graduated into the recession in the early 90s when development stopped. So, I began by necessity in the bank’s workout and restructuring group. I then worked at Citibank. There were a lot of smart people there from whom I learned a lot. I moved from the foreclosure group into the asset management group because the people running the real estate group did not wish to foreclose on all this prime real estate to sell at the bottom of the market. We would add value first. That is the approach I learned and repeated throughout my different jobs, particularly this one. After that, I was introduced to Private Equity Group. This was when a lot of private equity funds formed to take advantage of the RTC sales, and the real estate private equity world was born. A group of DLJ real estate capital partners needed an asset manager. I became asset manager for their deals on the West Coast, which evolved into overseeing deals across a lot of Japan. I learned a lot of hands-on stuff there, working with partners, doing JVs, financings, refinancing, and sales. It was a lot of everything everywhere. After DLJ, I worked at Cerberus, which was a very large alternative investment group with a real estate division. Cerberus had super smart people. I was able to learn from them, but also contribute skills they didn’t necessarily have-- execute on an idea with very active asset management. I then became sort of a deal sourcer for the West Coast; a lot of home building activity. After leaving Cerberus, a friend and I started our own investment advisory group. We bought a hotel in Calabasas and totally repositioned it, turned it into a hip, but not too hip, independent hotel. I then received the call for Tribune Media.

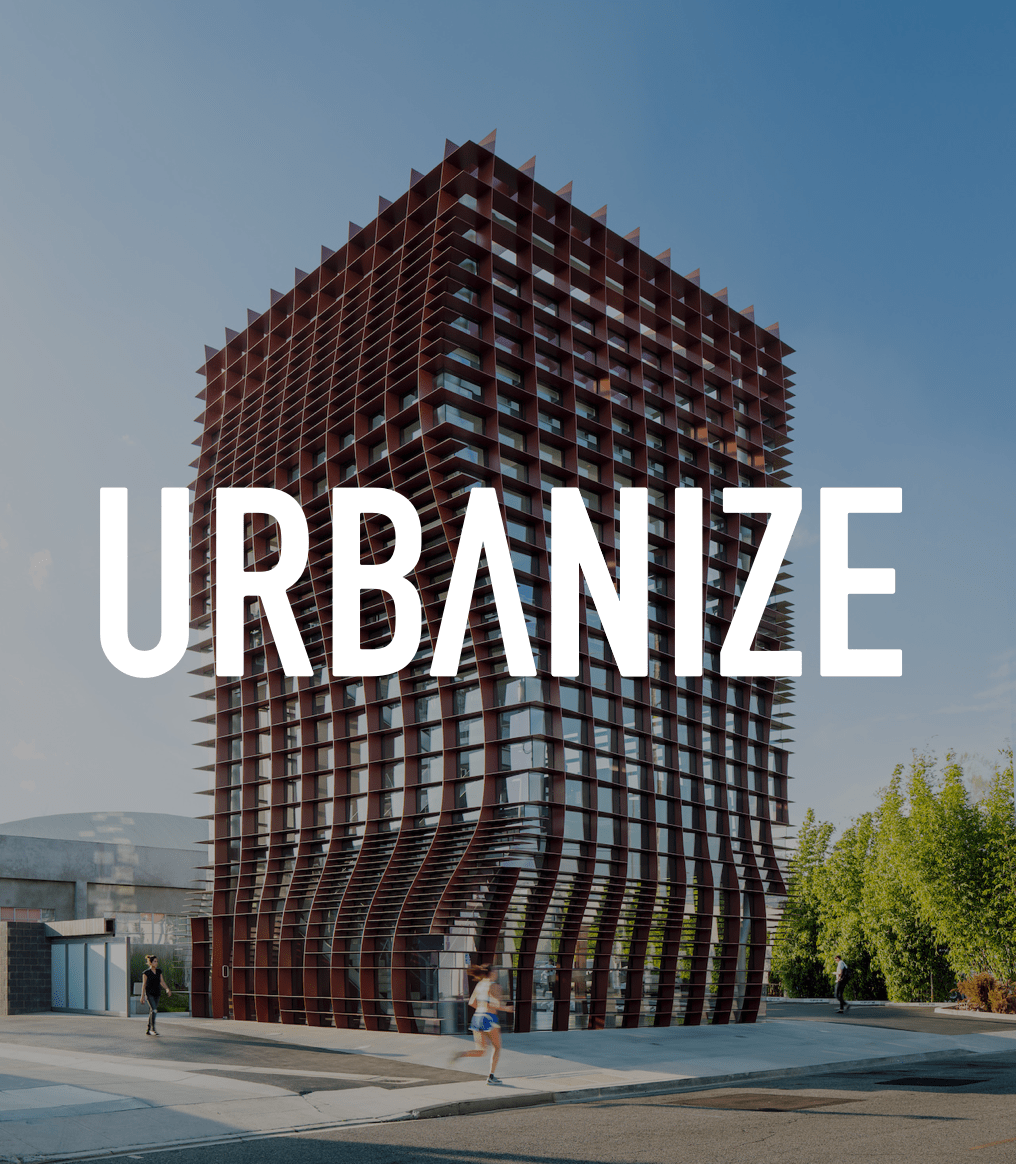

Rendering of Tribune's proposed mixed-use tower above the Historic Broadway subway station in Downtown Los AngelesSolomon Cordwell Buenz

Rendering of Tribune's proposed mixed-use tower above the Historic Broadway subway station in Downtown Los AngelesSolomon Cordwell Buenz

JG: I want to return to one of the first things discussed--how you graduated into a recession. Do you have any words of wisdom for today’s new graduates?

MQ: If you’re starting off in a down cycle, it’s a great time to learn. And a great time to learn with money that is not yours. You can see what went wrong with a deal and what should have been done differently. You retain and utilize that learning as you eventually become a manager and deal person. Starting in a down economy may not be much fun, but you learn a lot more if you make the most of it.

Jake Goldstein is an entrepreneur at the intersection of blockchain and real estate. He is currently a professor at Urban Land Institute Jake’s first ventures were a data analytics tool for metaverse land and an AI-powered content news aggregator for commercial real estate. He has been involved in Urban Land Institute for 4+ years as an active member of the Young Leaders Group (YLG). Jake started his career as a research analyst at Marcus and Millichap in their corporate headquarters in Calabasas. He received his bachelor’s in Business Administration, Marketing from Chapman University.