In the dynamic world of commercial real estate, there are numerous variables that can influence the success of a project. One of the most significant, yet often overlooked factors, is property tax expenses. As the number one controllable expense in real estate, property tax can have a profound impact on a project's bottom line. It's an element that, if not managed effectively, can erode profits and jeopardize the financial viability of a development. However, with the right approach and expert guidance, property tax can be strategically managed to enhance profitability and secure a healthy return on investment.

Section 1: The Current Landscape

The landscape of property tax in the state of California, specifically Los Angeles County is currently in a state of flux. The County Assessor’s office is facing myriad issues, including a shortage of seasoned personnel, and has yet to issue notices for new construction values for many developments built before 2020. This delay has left developers with a false sense of hope that the partial new construction value enrolled by the county is the only bill they will receive. Developers often do not realize that an additional, higher bill is lurking around the corner.

The implications of this delay are far-reaching. Without a clear understanding of their property tax obligations, developers may find it challenging to accurately forecast their expenses and potential returns. This can make it difficult to secure a permanent loan. Furthermore, the lack of clarity may also expose developers to the risk of unexpected tax liabilities down the line, which could negatively impact profitability.

It's more important than ever for developers to take a proactive approach to managing their property tax obligations. This is where Paramount Property Tax Appeal comes into play. Many experienced developers turn to Paramount to evaluate a project before purchasing a construction site. Estimates for tax budgets are created prior to site acquisition, more defined budgets and valuations are determined through the partial construction phase and final valuations submitted to County as project nears issuance Certificate of Occupancy. This proactive approach results in a lower Enrolled Value and a lifetime of savings for developers.

Section 2: The Risks of Not Having a Plan for Property Tax

The process of property valuation, which forms the basis for property tax calculations, is not infallible. Assessors can, and do, make mistakes when valuing new construction. These errors can lead to inflated property tax assessments. For developers, this can mean a significant and unnecessary financial burden, which can be particularly damaging in the already high-stakes environment of new construction .

Common Mistakes and Assumptions Many Developers Make

- Assuming property taxes will be based on the cost reported on a permit is a myth: The Assessor conducts their own valuation.

- Assuming that the hard cost of construction will be the property tax assessment: The Assessor Considers both hard and soft cost construction cost, interest on construction loans and entrepreneurial profit. Even if they take this approach, mistakes are often made, resulting in higher values than are fair.

- Over-sharing information with the Assessor: Information submitted without review by a tax professional can be used against a developer.

- Choosing to self-represent during property tax appeals: There are only a few property tax experts in California that have the skill and experience to properly value new construction projects, make sound, data-driven arguments for equitable assessment, and present a case before the Assessment Appeals Board to successfully rebut the case for a higher enrolled value.

Section 3: The Tax Savings Strategy Guide

To further support developers in their property tax management efforts, here are 3 tax savings strategies for new construction.

1. Understanding Property Tax Assessments: Valuation Methods Adopted by the Assessor

- The Cost Approach: Although not the Assessor's preferred method, it is often beneficial to the developer.

- The Assessor may use both actual costs and the market cost approach utilizing the Marshall & Swift Commercial Building Cost Data Guide.

- If the Assessor suspects underreporting, they refer to their market cost guide, usually opting for the higher value.

- The assessed cost will include an additional 15-20% entrepreneurial profit.

- It's common for the Assessor to assign an improvement value higher than the actual expenditure on the property.

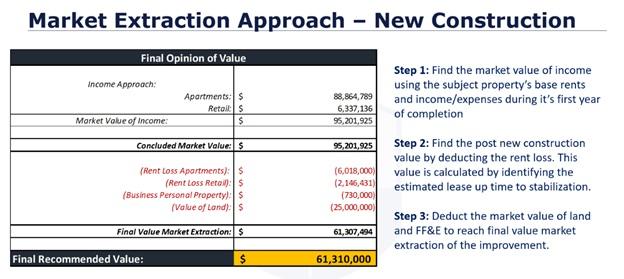

- Sales or Income Approach (also known as the Market Extraction Approach):

- The Revenue Taxation code mandates that new construction valuation should not surpass its fair market value. This balance between the new construction's value and the economic market value at completion is complex due to various influencing factors. It's essential to note that the "actual cost" doesn't necessarily reflect the "actual market value."

- Increasing costs of land and development often mean that construction costs outpace the market value.

2. Spotting Potential Errors: Common Oversights by the Assessor’s Office:

- Many values are set arbitrarily without comprehensive evaluation.

- Failing to accurately calculate and apply lease-up rental loss.

- Misjudging the land's value. Higher land values are typically beneficial for new construction assessments.

- Over-relying on actual or the Marshall & Swift book costs without acknowledging that cost doesn't always represent value.

- Neglecting considerations of functional or external obsolescence, especially those stemming from external factors.

3. Property Tax Saving Tips for New Construction:

- Understanding the Nature of the Construction:

-

- Ground-up New Construction

- Change in Use

- Repairs or Tenant Improvements

- Expansion

-

- Determining the Type and Classification of New Construction:

-

- Real Property: Pertains to land and structures. These are subject to assessments influenced by Proposition 13, increasing by 2% yearly from the base year.

- Fixtures and Personal Property: This category depreciates annually, typically spanning a 5-20 year life depreciation.

-

Paramount offer a free Tax Savings Strategy Guide on our website. This guide provides valuable insights into effective tax-saving strategies for new construction.

Section 4: The Winning Strategy

At Paramount Property Tax Appeal, expertise in property tax law is combined with a dedicated approach tailored to each client's unique needs. We conduct a meticulous review of property tax assessments for potential errors and leverage real estate market insight to perform an independent valuation on all projects. When discrepancies arise, a well-researched and executed appeal is warranted.

Paramount represents nearly 25% of L.A.'s developers, and has an impressive record of successfully reducing new construction enrolled values. Recently, Paramount was able to secure a reduction in assessed value for a developer which translated to over $134,000 in annual property tax savings.

The intricacies of property tax, especially given their dynamic nature, demand specialized attention. That’s where Paramount Property Tax Appeal excels, guiding clients through the maze of evolving regulations and procedures. For developers in the midst of construction, utilizing specialized property tax consulting expertise to estimate upcoming property tax expenses and implications prepares them for the future.

Learn more at: https://www.paramountpropertytaxappeal.com/